April 12, 2023

Credit Score Solutions: Why Your Credit Union Needs One

Look at your 2023 goals and objectives for your credit union. Do you see these items: improve your members’ financial well-being, strengthen customer loyalty, or strengthen your bottom line? If you do and are looking to fulfill these initiatives before 2024 rings it, it is time you implement a credit scoring solution.

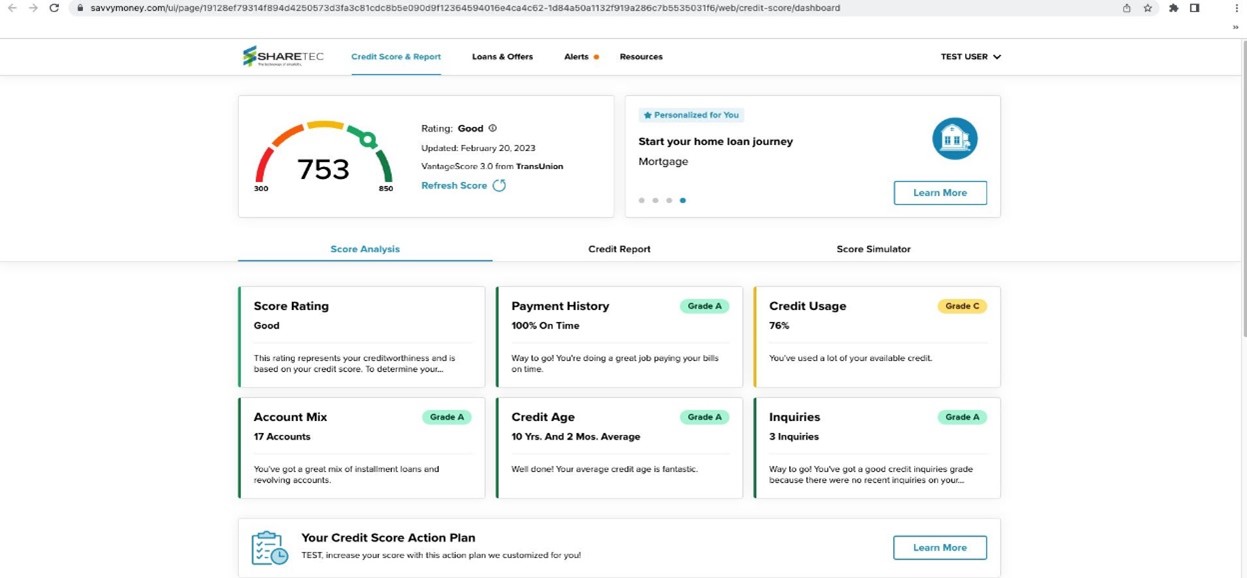

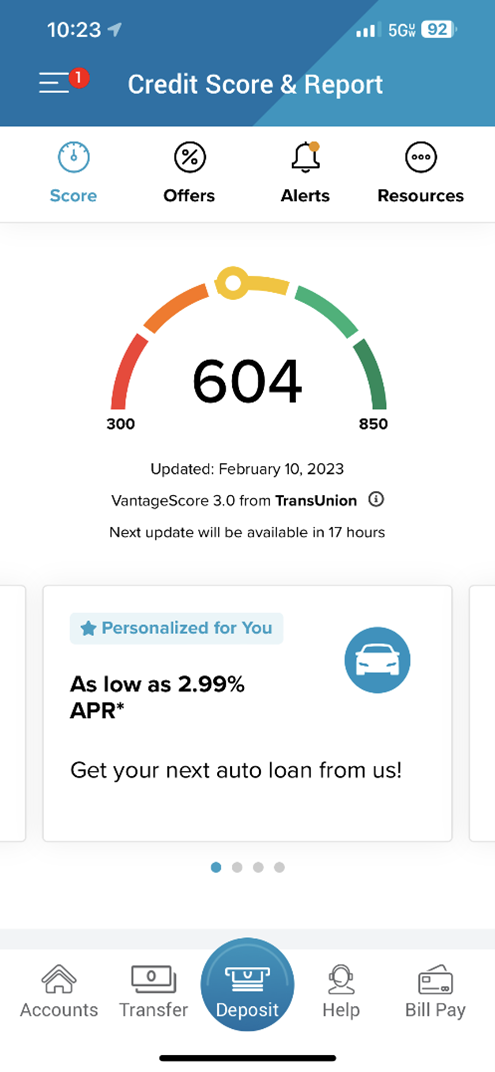

Sharetec integrates seamlessly with SavvyMoney, a solution built to accelerate credit unions’ business and meet member demand for instant credit scoring and reports. So, why should your credit union offer a solution like SavvyMoney? Here are some of our top reasons:

1. Provide Members with Financial Data They Need

Your members need instant access to their credit score to determine their position when applying for a loan. Members need to know if they will be good to go when it comes time for approval or need to work on boosting their credit score before making a financial decision.

2. Deliver Members Offers That They Want & Need

Money-saving loan offers are not one-size-fits-all. Your members need to receive offers that will match what they’re looking for (at the time they’re looking for it) and their financial position. With SavvyMoney, you can deliver offers to the right member at the right time, all through the digital platform.

Since you’re offering members loan opportunities based on their credit profile and your lending criteria, you can book more loans. Scott & White Employees Credit Union received over 115 loan applications and secured 87, totaling over $1.6 million, in just six months after implementing SavvyMoney. Click here to read more about SWECU’s success with this integration.

3. Quickly Provide Financial Education to Your Members

Making a financial decision can be daunting and cumbersome and often needs clarification. Since financial decisions are paramount, your credit union should guide members. With SavvyMoney, you can access financial education tools, including curated content and interactive rate simulators, so your members do not have to play guessing games.

4. Automate Your Lending Process

You and your credit union team should be focused on building relationships with your members, not messing around for hours building and executing campaigns. With SavvyMoney’s pre-approval campaign management, you can transform pre-screened lending into a fully automated process, which will help boost engagement and drive conversions.

5. Help Members Execute Their Credit Goals

SavvyMoney recently announced a new feature that will be rolling out within their Credit Score solution, “Credit Goals.” By accessing this tab from the main dashboard, members can create their own personalized Credit Goals, inputting their desired credit score and determining when they want to achieve it. Members will then be provided with recommendations on how to achieve this goal and track their progress.

6. Make Loan Application Easier & Drive Application Completions

In a perfect world, every member would complete a loan application in its entirety and submit it; however, that is not the case. That’s where credit scoring integrations come in. These applications can assist in streamlining the loan application, making it quicker to complete with fewer clicks – while providing digital users with personalized offers. The fewer clicks in the application process, the more likely the application is to be complete.

Prior to leveraging SavvyMoney’s loan application process, one credit union saw an average completion rate of 45%. After implementation, the completion rate rose to 63% with a whopping 145% increase to application submissions.

SavvyMoney is quite straightforward to implement, receiving a 4.9 out of 5 launch score. And there’s proof in the pudding. Over 1080+ financial institutions have already implemented SavvyMoney, with over 30M consumers reached and $3.8B in loans driven via the SavvyMoney offer engine. So, isn’t it time your credit union hopped on the SavvyMoney train?

If you are interested in learning more about Sharetec and the SavvyMoney integration or are already a Sharetec customer seeking a credit scoring option, please get in touch with us today or call 844-802-4441! We can work together to ensure your core processing software is packed with all the features and integrations to make your members’ (and staff’s!) lives easier.