Experience RDC.

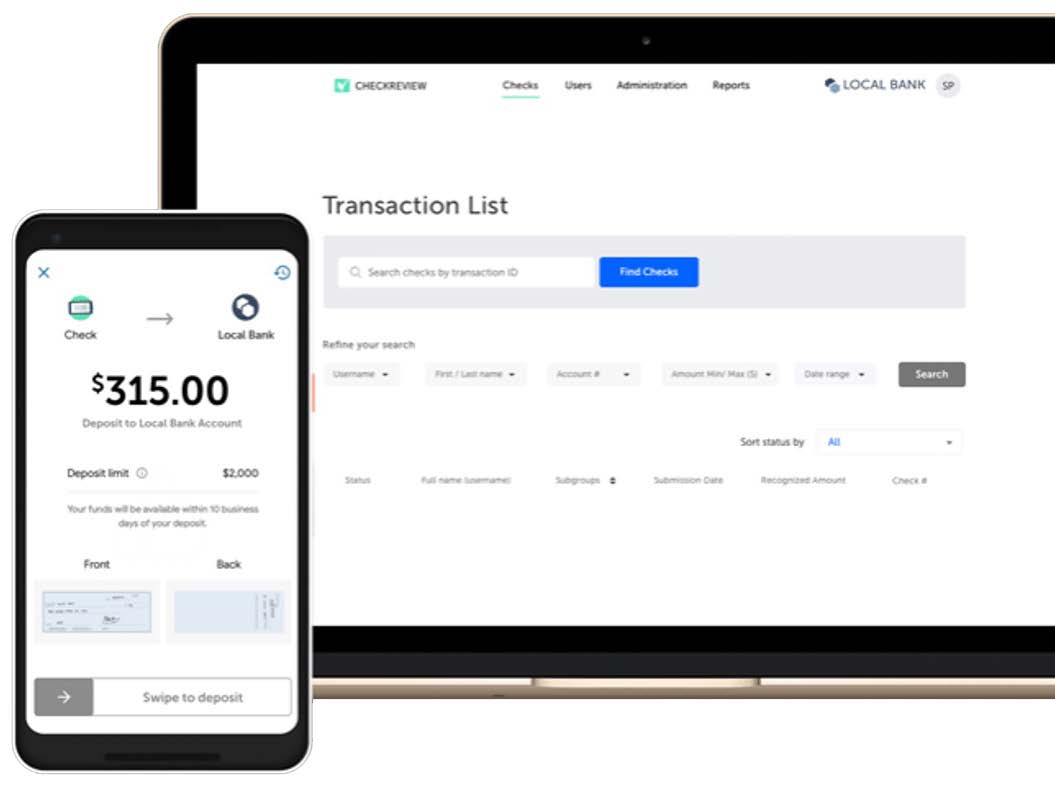

In today’s digital-first world, mobile check capture is a “must-have” solution for your credit union and your members. With Urban FT Remote Deposit Capture (RDC), you can add a new 24/7 deposit channel that will enhance your members’ mobile banking experience, reduce the burden on deposit operations, reduce in-branch traffic, and drive more check acceptance.

Learn MoreConsumer RDC

Remote Deposit Capture

You can now deploy a member mobile experience that allows members to deposit their checks anywhere, at anytime.

- Urban FT is integrated into Sharetec On-the-Go Digital Banking

- Urban FT’s CheckReview™ service helps to mitigate risk for your credit union

- Check processing includes image cash letter, posting file creation, and batch processing

- Urban FT includes many feature enhancements to improve efficiency, reduce costs, and mitigate additional risk

CheckReview™ Service

Minimize Risk

Urban FT’s dynamic risk mitigation tool allows credit unions to take an ‘out of the box’ solution for check management that delivers the ability to:

- Monitor check images in real-time

- Mitigate fraud with flexible rules configuration

- Track transactions and usage with reporting

- Define and monitor deposit activity thresholds

- Enhance compliance monitoring

- Set and manage multiple user groups

Ready to Learn More?

"*" indicates required fields