Market-leading payment innovations for credit unions.

With Neural Payments, credit union members can make peer-to-peer (P2P) payments via your CU’s digital banking platform, Sharetec On-the-Go. Your members can say goodbye to having to download a separate app when wanting to send friends and family money.

Neural Payments is unlike the P2P platforms your members are used to. They’ve shifted the P2P model to be sender-driven, eliminating the need for the sender to coordinate apps with the receiver. Once money is sent, the recipient has the choice to decide where they want funds to go.

Learn MoreWhy does your credit union need Neural Payments?

Credit unions must offer a P2P solution to stay competitive, but limited options exist. Many P2P payment systems have small networks, so two people moving money via P2P can become a headache rather than a seamless transaction.

Other providers are expensive – direct costs are high, settlement and data requirements are complicated, and implementation is pricey and takes too long. By their design, they are also vulnerable to fraud, as they provide more touchpoints (such as a registration process) that can exploited by bad actors.

The Neural Payment Experience...

Neural Payments provides solutions that help harness growth opportunities, streamline operations, mitigate risk, and help drive change in the marketplace.

Easy for Users

As a sender-driven system, members no longer have to coordinate apps with receivers

Fast

Funds transfer instantly from person to person

Cost-Effective

Credit unions can attract an entirely new market of customers via digital channels, reducing cost

Vehicle for Growth

Your credit union can draw deposits back into your ecosystem with your new P2P capabilities

Security, Prioritized.

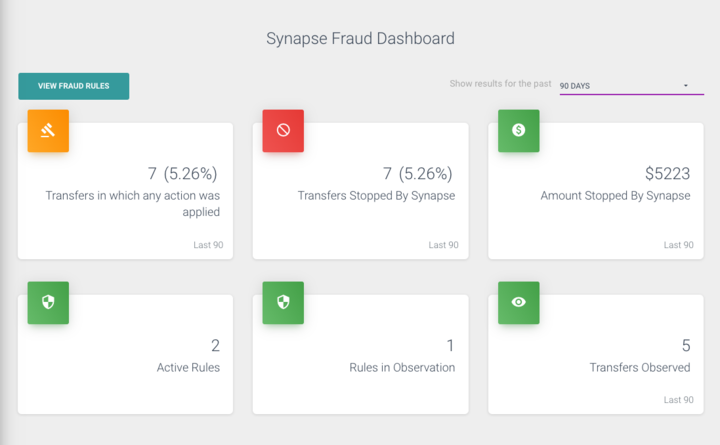

Fraud happens – and it happens even more frequently with P2P transactions. Neural Payments reduce headaches and losses for credit unions and their members with their P2P Fraud Rules Engine. This proprietary, revolutionary technology leverages real-time automation to lock down, evaluate, and respond to suspected transactions.

- Customize rules for specific trigger events

- Specify the response with corresponding actions

- Identify fraud based on customized rules

- Test, enable, and manage rules on the Fraud Rules Engine dashboard

Want a demo of Neural Payments

Contact us today to schedule a 1:1 look at Neural Payment's P2P functionality!

"*" indicates required fields