Member-preferred lending solutions.

Digital transformation is rapidly changing the landscape of credit unions, with members expecting a digital-rich experience. MeridianLink is there to help credit unions provide members with cutting-edge digital lending capabilities. Loan processing has never been more seamless and more member-friendly than now.

Learn MoreMany Benefits of MeridianLink®

For more than 20 years, MeridianLink has built intimate relationships with its credit union partners, helping to accelerate member satisfaction, maximize cross-sell opportunities, reduce costs, minimize risk, improve efficiencies, and go digital. Your credit union can also experience:

- Increased Satisfaction: With automated decisioning capabilities, your members will experience speedier turnaround times and more accurate results. Plus, more efficient processes mean happier credit union employees.

- Increased Revenue: You can deepen your relationships with members and further boost your bottom line through the MeridianLink®/Sharetec integration. This integration will help you uncover additional cross-selling opportunities.

- Reduced Costs: Your credit union will be able to cut down on manual workload and develop a consistent user experience with time- and cost-saving workflow automations.

SaaS Loan Processing for Credit Unions

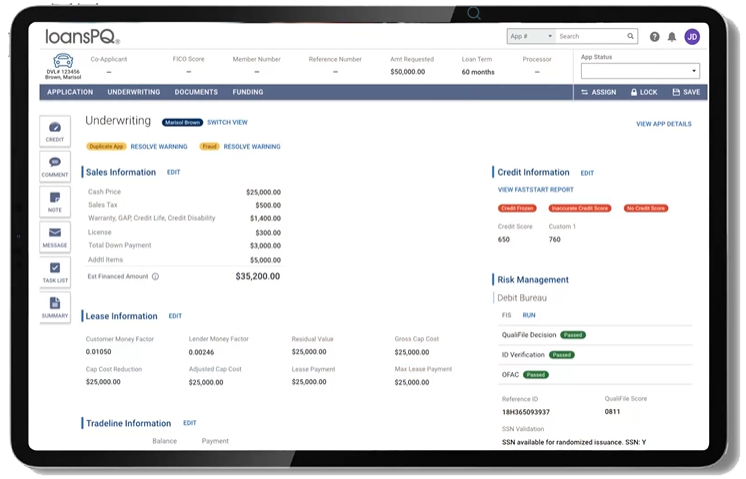

Improve your member experience with MeridianLink® Consumer, an end-to-end digital loan origination system (LOS) that supports direct, indirect, credit card, personal, HELOC, and business loan types. Easily consolidate data from all your existing channels – mobile, online, branch, call center, and more – into one single origination point. MeridianLink® Consumer is comprised of over 1,000 configuration points, hundreds of third-party integrations, a robust underwriting and pricing engine, full loan product suite support, and more, to fit the needs of your credit union.

Frictionless Digital Lending

Automated end-to-end digital lending process with the industry’s leading consumer loan origination system (LOS)

Modern User Experience

A cutting-edge user interface that’s built on innovative cloud-based technology

Advanced Decision Making

Leverage MeridianLink®’s automated decision and underwriting engine to make decision more efficient

Single Loan Origination

MeridianLink® Consumer integrates with Sharetec for a secure, fast, and reliable experience

Web-Based SaaS Delivery

The SaaS model means that your credit union will receive frequent updates that ensure compliance and quality for your LOS

Full Loan Product Suite

MeridianLink® supports various direct and indirect consumer and business loan types

Share-of-Wallet Module

Experience something new from MeridianLink®

The new Share-of-Wallet (SOW) add-on module for MeridianLink® Consumer will help your credit union capture a greater portion of your members’ financial business. By combining lending and deposit pipeline generation with existing LOS capabilities, your credit union can expand your member base, increase wallet share, and boost member lifetime value, all while lowering acquisition costs.

- Target new opportunities and focus on relationships your members may have elsewhere

- Use application and credit data to identify cross-sell opportunities

- Deliver data-powered personalization with Tech Enabled Marketing (TEM). Customize campaigns, add incentives, and utilize various marketing strategies.

Ready to discover more?

Contact Sharetec today to learn about the benefit of Velocity and MeridianLink.

"*" indicates required fields