April 5, 2023

7 Topics Credit Unions Need to Communicate with Members

Credit unions often form strong, long-lasting relationships with their members – and provide members with more personal service when compared with banks. To help strengthen the close-knit relationship members seek, credit unions need to improve communication. Your members need to know your credit union cares about their financial well-being, and they need to be informed on the newest happenings at your CU.

While choosing frequency, cadence, and delivery method is crucial in planning a proper communication strategy, one thing is sure: credit unions must be in contact with their members. So, what should CUs be reaching out to their members about? Here are seven topics that credit unions should be sending information out on:

Digital Tools

Are you rolling out a new digital tool, such as a mobile app, that you want your members to adopt quickly? They need to know it’s coming – and many of your members may need assistance downloading the app, registering for an account, and navigating through it. You cannot assume all your members will know how to access a new digital tool flawlessly.

Technology Changes

If your members already leverage a mobile or desktop app, keep them updated when large changes may impact them. A significant difference could include an interface overhaul or a new application process (or different types of applications that they couldn’t previously apply for online). Your team can disseminate this information via email, an interstitial on your website, or a push notification through your app.

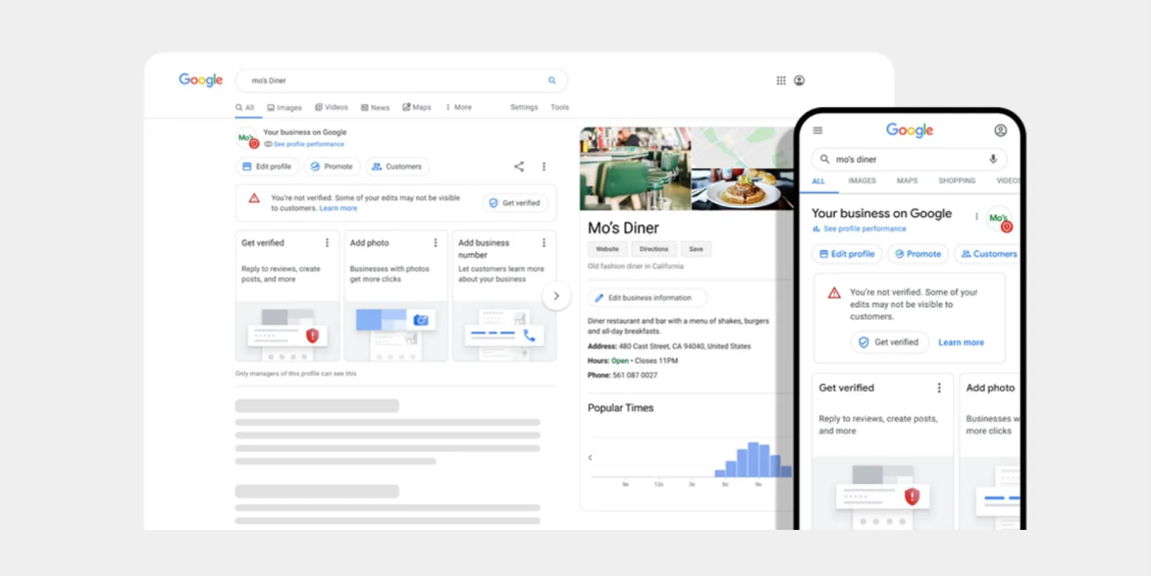

Operational Updates

Closed for a holiday? Are Call Center hours changing? Don’t leave your members hanging outside a locked door when you unexpectedly have to close due to inclement weather. These updates can be sent digitally, old school (a door sign), or on your Google Business Profile. 94% of local businesses receive Google Business Profile calls on weekdays, so if someone isn’t going to be able to answer the phone because the branch is closed, make sure you list accurate hours on your GBP.

New Rates

If you’re offering an enticing auto rate for a 60-month new car loan or you’ve increased the interest rate on a CD, let your members know. Chances are, big banks and other lenders are bombarding your members with digital ads on their products, so your members are aware of what the competition is doing. So, CUs must communicate desirable products and enhanced rates to members.

Customized Offers

Credit scoring tools, like SavvyMoney, allow credit unions to personalize ads and messages sent to CU members. SavvyMoney matches customers with money-saving offers that will improve a member’s financial situation. With a tool like SavvyMoney, you can quickly spin up personalized messaging and automated marketing campaigns to effectively communicate this information to members.

Customer Feedback

When did your credit union last ask members what they wanted? As credit union professionals, we may assume we know what members seek. And maybe, with our wealth of experience, we do; however, the members themselves are the best people to define what they want in products and services. Reach out to your members to see what change you could implement to help better their experience.

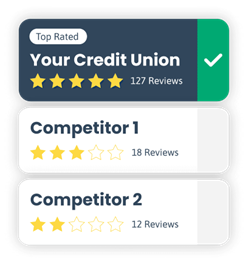

Customer Review Requests

Reputation management is essential for business success in today’s day & age. 85% of consumers trust a review as much as they would trust a recommendation from a friend. You can reach out to your members about leaving a Google review about your CU. Send a quick text message to your members, requesting they leave a review. It’ll 1.) show you care about their feedback and 2.) help you win when it comes to Local SEO. Text messaging is an excellent choice for channel, too. According to Eltropy, text message review requests receive 8x more engagement and 44x faster response rates than other methods.

Connecting with your members is something you can start with today, even if you need more marketing or support staff. Tellers and Loan Officers can begin transmitting important messages from behind the desk to their members. And when you have a strong core processor for your credit union with Open API integration with many robust communication tools, you can rest assured that your members are informed when they need to be. All that can happen when you transition to Sharetec, helping propel your credit union operations.

Looking to learn more? Interested in new credit union core processing software? Contact Sharetec now and discover more about our innovative, comprehensive web-based core with features you, your team, and your members need.